Proforma invoices are one of the most frequently used invoicing documents. If you are scratching your head thinking about the differences between proforma invoice and regular invoices, we've got your covered with this explainer article.

You will learn about the following aspects to proforma invoices:

- What is proforma invoice?

- How proforma invoices are different from invoices?

- How can you create and send proforma invoices?

Let's get started!

What is proforma invoice?

A proforma invoice is essentially a standard invoice that is sent out to clients ahead of time before the work is completed or business transaction finished. It is a way to get approval for a project or partnership and show the client what it will cost them among other information that will also be later given on an official invoice.

Another way to look at a proforma invoice is that it is not officially recorded on the books by an accountant and thus not subject to government regulations. Thus, discarding it without a credit note is no problem. You can then reissue a correct invoice or even another proforma to make sure you and the client are on the same page. A proforma will not charge money for your clients, but lists the amount due eventually when the real invoice gets sent out. The buyer, seller or any bookkeepers and accountants will not need to worry about creating entries in accounts receivable nor accounts payable.

Another good way to look at a proforma is that it is issued before the placement of the order or the job while an invoice can be issued after the work is complete and before payment is made as a form of payment request. It is a creation of a sale in a sense and not a confirmation of the sale. It can aid the buyer or your client in making a decision on whether to place the order and be comfortable with the payment terms among other things rather than in the actual books of an accountant.

“Proforma invoice is a kind of quotation, containing a commitment by the seller to supply goods at the specified rate and date,” according to KeyDifferences.com, “Conversely, Invoice is a sort of bill, displaying the amount due to the buyer.”

What is the difference between proforma and an invoice?

An invoice is not negotiable and can officially only be corrected with a correction note added onto it, however a proforma can easily be replaced or negotiated. It is also provided by the buyer instead of the seller as is the case with a standard invoice.

Getting familiar with proforma invoices is a good practice as it will show your clients or partners that you are willing to negotiate and be flexible on terms ahead of time if you allow them to send you a proforma. You can always refuse or not agree to its terms later and negotiate a better service plan for the future work and invoice that you will be sending out. It is also a good way to get information from the buyers side about what to expect in the final invoice and often used as precedents to credit notes or other documents.

How to issue a proforma invoice?

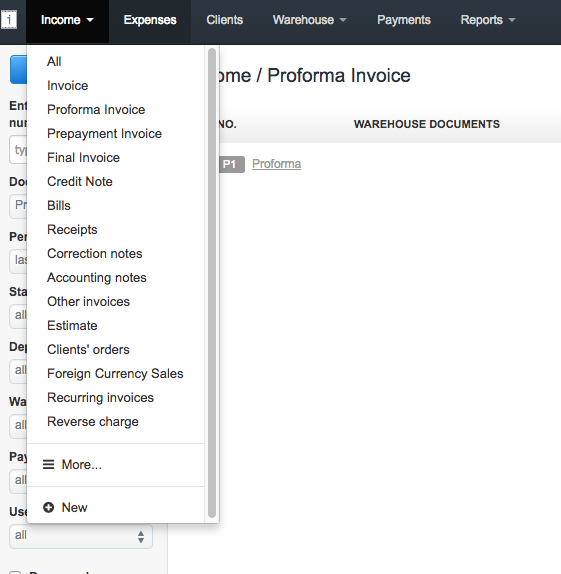

With InvoiceOcean, you can create a proforma invoice by clicking on the drop-down arrow under income and selecting the big blue “Add new” button below. At first glance it may appear just like a standard invoice and in a way it is. The main difference is that it will have a default numbering system as P and a number following it. A standard invoice usually just has the number present in this field.

Our system implements proforma invoices seamlessly and you can later view them right from the menu when going to Income>Proforma invoice. You will see a list of proforma invoices you already issued and can issue a new one as well by clicking on Add new as mentioned earlier.