Some Ways Invoicing Differs in the U.S. and Europe

Sending and receiving invoices varies around the world with each country having its own system in place that governs invoicing standards. However, general trends are followed among member states in the EU (for the most part), or states in the U.S. It is when we have to send invoices across farther geographical regions that we start running into barriers or real differences in the invoicing process.

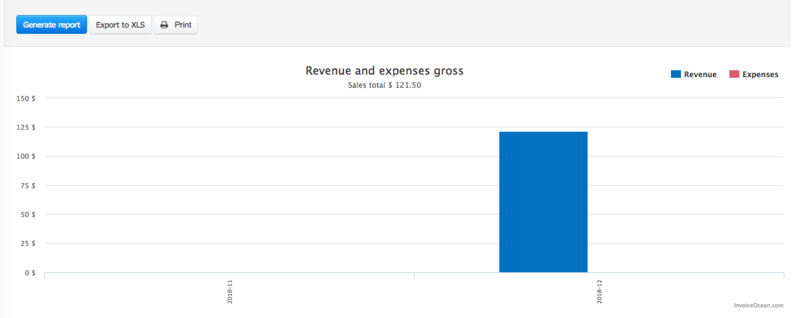

An example of this is paying sales tax in the United States vs VAT rates in Europe and the United Kingdom. Another example is whether we pay the invoice based on the tax rate of the supplier vs customer, which can vary in different parts of the world. Finally, there are differences in what needs to be included on an actual invoice for it to be considered legitimate.

Mike Lata (aka Maciej Duraj)